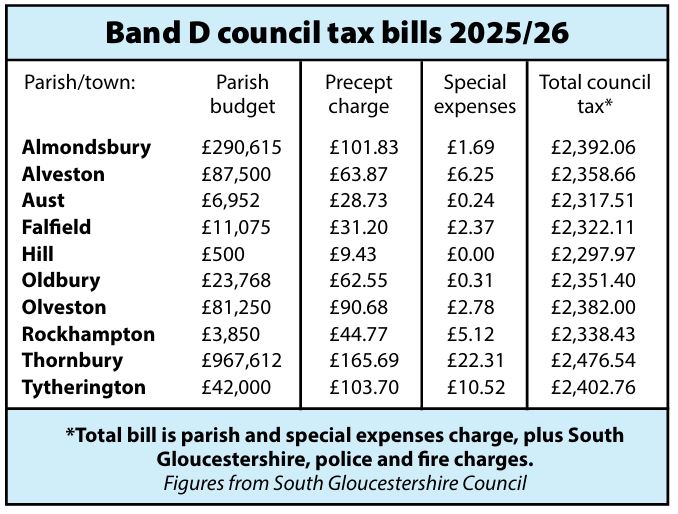

A TYPICAL council tax bill in Thornbury will rise by just over £116 in April.

When increases in the charges levied by South Gloucestershire Council, the town council, the police and fire services are added up, a Band D householder living within the area covered by Thornbury Town Council is set to pay an extra £116.44 or 4.93% this year, with their total bill rising from £2,360.10 to £2,476.54.

Charges vary according to property values, with this year’s overall charge in Thornbury ranging from £1,651.03 for Band A householders to £4,953.08 for people with homes in Band H.

South Gloucestershire Council agreed a 4.99% increase – the maximum allowed without calling a referendum – at its tax-setting meeting in February, to take its charge to residents with homes in the average Band D tax bracket up by £90.54, from £1,814.37 to £1,904.91.

The council also makes a separate ‘special expenses’ charge, which varies between areas, for neighbourhood services such as parks that it maintains.

The rest of the increase in overall bills comes from other public bodies.

Police and fire charges up by £19

Avon & Somerset’s police and crime commissioner Clare Moody is raising charges for a Band D tax payer by £14 (5.01%), from £279.20 to £293.20.

Avon Fire Authority is raising its annual charge by £5 or 5.85%, from £85.43 to £90.43 in Band D.

However the final amount paid by people living in different areas varies according to the services provided by their parish councils.

Town and parish councils are not subject to government restrictions on how much they can raise precept charges without calling a referendum.

In the Thornbury area most are raising their charges by a smaller percentage than South Gloucestershire’s 4.99% this year – in contrast to last April – with some even reducing them.

Thornbury has the highest charges for both precept and special expenses, with the result that the overall council tax bill in the town is higher than in surrounding parishes, as it includes £165.69 in parish precept charges and £22.31 in special expenses.

The town council’s precept budget has risen by 3.88%, from £931,436 to £967,612.

Its charge to Band D home owners is up by £5.21 or 3.24%, while special expenses paid to South Gloucestershire are up by £1.69 or 8.2%.

Where to find the lowest bill

The lowest Band D charge in the area is for Hill – the £2,297.97 total bill (up 5%) includes a precept of just £9.43, unchanged from last year, to fund the parish meeting. Residents pay no special expenses.

In Alveston the Band D precept charge has risen by £2.88 (4.72%) and special expenses by 40p. The overall bill for residents is up by £112.82 or 5.02%, to £2,358.66.

In Olveston the Band D precept charge is up by £4.33 (5.01%) but special expenses have been cut from £6.48 to £2.78 (down by 57.1%). The overall Band D rise is £110.17 or 4.85%.

In Almondsbury the precept budget is unchanged on last year and an increase in households in the parish means the Band D charge has reduced by 12.1%, from £115.88 to £101.83, with special expenses down by 53.4% from £3.63 to £1.69. The total bill for Band D taxpayers is up £93.55 or 4.07%.

In Tytherington the precept has risen by just 76p (0.74%) and special expenses are up by 83p. The total Band D bill is up by £111.13 or 4.85%.

Overall bills are up by 4.88% in Falfield and 4.9% in Rockhampton – where both parish councils have also reduced their precept charges – by 4.97% in Aust, and 4.98% in Oldbury-on-Severn.

The highest council tax bills in South Gloucestershire are in Filton, where the parish council’s Band D charge is £312.33, and total bills are £2,610.75 from April.